About the research

Commercialization That Works distills insights from a survey of 120 biopharma leaders and more than 20 interviews with launch veterans.

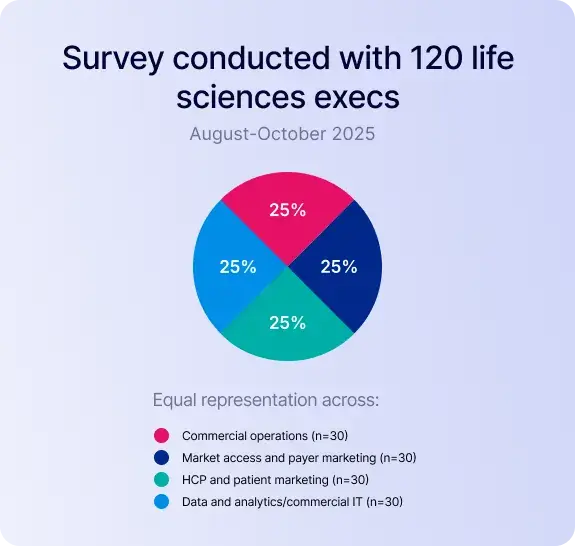

Survey conducted with 120 life sciences execs: August-October 2025

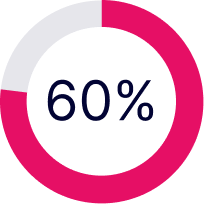

- Commercial operations (n=30)

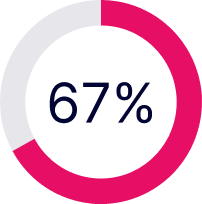

- Market access and payer marketing (n=30)

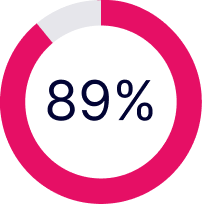

- HCP and patient marketing (n=30)

- Data and analytics/commercial IT (n=30)

Interviews conducted with:

- 7 life sciences commercialization execs (May 2025)

- 11 Beghou partners (June 2025)

Panel discussions conducted with:

- 8 life sciences commercialization execs across 3 events (September, October, and November 2025)

.webp?width=2000&height=2921&name=Report%20Image%20(2).webp)

.webp)

.png)

.png)